How we organise our business and our revenue generation model

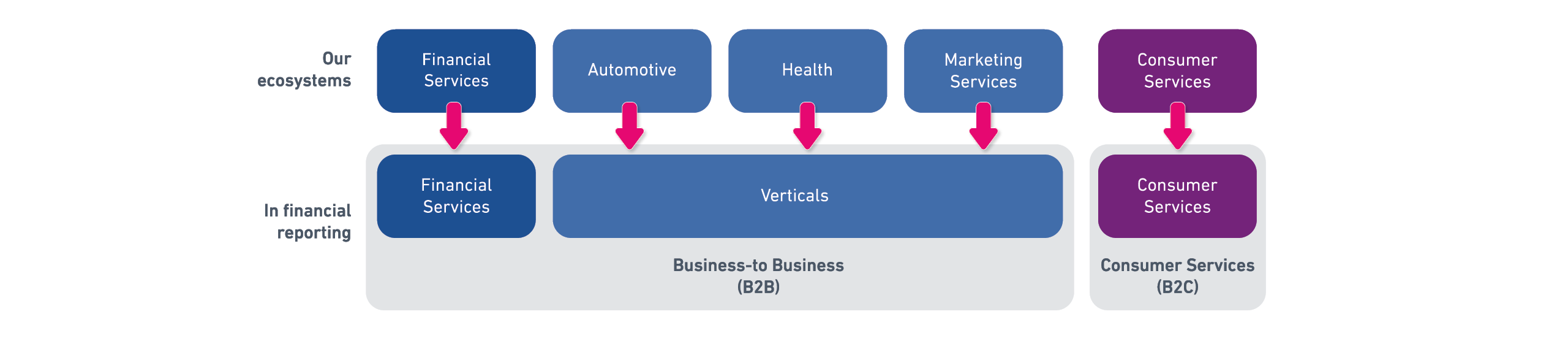

Over the past two decades, Experian has transformed into a data-enabled technology company from its roots in credit bureau activities. Historically, we described our business in terms of two segments, Business-to-Business and Consumer Services. While this framework reflected our heritage, it no longer fully captures the breadth of what we do today.

Today, we are organised around five ecosystems: Financial Services, Consumer Services, Health, Automotive, and Marketing Services. Each represents a large, growing addressable market where we bring together unique data, advanced analytics and scalable software platforms to deliver innovative solutions to clients and consumers. This shift reflects how our businesses operates in practice and how we develop strategy.

Financial Services

What we do

We provide data and software to help clients at every step of their customer journey: we help our clients to find and onboard new customers, assess creditworthiness, prevent fraud and meet regulatory requirements. Our ambition is to deliver the majority of these services through our integrated Ascend platform, through a system we refer to as Enterprise Decision Intelligence.

Key clients

Our clients are financial institutions such as banks and lenders, telecommunications insurance and utility providers, as well as government and public sector institutions.

Key datasets

- Consumer and commercial credit bureau data

- Trended and alternative credit data

- Fraud and identity data

- Income and employment verification data

Revenue model

Revenue is generated via transactional and fixed-term data contracts, batch data services, recurring software licences and recurring support for our solutions. We also provide consultancy services for analytics and regulatory governance.

Market position

We are the largest credit bureau in the world. We hold the number one or two position in all of our major markets including North America, Latin America, the UK & Ireland, and Australia and New Zealand, supported by a growing presence in other selected international markets. Our scale, combined with our integrated platforms and unique consumer-permissioned data, gives us a strong and defensible leadership position.

Other market participants:

Equifax, TransUnion, and specialists participants such as FICO, LexisNexis Risk Solutions, CoreLogic.

Health

What we do

We support US hospitals, physician groups, and insurers by improving patient identity verification, eligibility checks, claims processing, and revenue cycle management. Our tools reduce fraud, improve efficiency, and help providers get paid faster.

Key clients

Hospitals, physician practices, and revenue cycle management providers in the US.

Key datasets

- Patient identity and demographic records

- Insurance eligibility and claims data

- Fraud and identity risk databases

Revenue model

Revenue is primarily generated by software subscription and long-term service contracts with hospitals and insurers for identity verification, eligibility checks, and claims management. Most clients are on multi-year agreements with high renewal rates, providing a stable and recurring base. Growth is driven by new analytics modules and increased digitalisation of the US healthcare system.

Market position

We are a leading provider in US healthcare revenue cycle management, serving ~60% of US hospitals.

Competitors

Waystar, Change Healthcare, Optum, and other revenue cycle and claims processing vendors.

Automotive

What we do

We provide automotive manufacturers, dealers, lenders, and insurers with data and analytics to better understand vehicles and customers. Our datasets help with credit decisioning at point of sale, vehicle history and valuation, and targeted marketing.

Key clients

Automotive manufacturers, dealer networks, auto finance providers, and insurers.

Key datasets

- Vehicle ownership data

- Vehicle history

- Loan, lease and finance history

- Consumer demographic and credit data

- Dealer and manufacturer network data

Revenue model

Revenue is derived from data licensing, subscription access to our vehicle databases, and transaction-based fees for vehicle history, valuation, and finance checks. These relationships are typically multi-year and embedded in client workflows, generating resilient and high-margin income.

Market position

We hold leading positions in North American vehicle identity and history data, with ~82% coverage of auto lenders. We operate one of the only two databases of vehicle history reports in the US.

Competitors

S&P Global Mobility, J.D. Power, CDK Global, Cox Automotive.

Marketing Services

What we do

We enable advertisers, agencies, and publishers to target audiences more effectively primarily across digital and connected TV channels. Using Experian’s identity graphs and consumer insights, we help clients enrich campaigns and improve their return on investment.

Key clients

Advertisers, media agencies, publishers, and digital platforms.

Key datasets

- Consumer identity and demographic data

- Digital identity & device graphs

- Audience segments and behavioural data

Revenue modelRevenue is primarily generated by subscriptions and usage-based fees for access to our identity graphs, audience segments, and campaign measurement tools. As the digital ecosystem shifts towards privacy-first, cookieless targeting, demand for our first-party data and identity solutions continues to expand.

Market position

We are a recognised leader in audience enrichment and identity resolution for digital advertising, particularly in cookieless targeting and connected TV.

Competitors

LiveRamp, The Trade Desk, Neustar (TransUnion), Nielsen.

What we do

We run one of the world’s largest direct-to-consumer financial platforms, with over 200 million members globally. We provide free access to credit scores and reports. We also help our members improve their financial position with a wide array of tools and connect to products such as loans, credit cards and insurance through our marketplaces. We also provide identity protection products. We are progressively embedding AI-enabled features to act as a financial co-pilot and provide personalised guidance.

Key consumers

We offer services to consumers in the US, the UK, Brazil and Colombia. At the same time, our platform also helps financial institutions, insurers, and other partners to reach these consumers more efficiently, making it both a trusted service for individuals and a valuable channel for partners.

Key datasets

- Credit report and score data

- Consumer-permissioned data

- Marketplace interaction data

- Engagement and behavioural data

- Identity and fraud protection data

Revenue model

We primarily generate revenue from premium subscriptions, referral fees from financial services and insurance partners in our marketplace, and fees from financial institutions for our white label services.

Market position

We are the market leader in consumer credit services in the US, UK, and Brazil.

Other market participants include:

Other credit bureaus (Equifax and TransUnion), fintech apps such as Credit Karma and ClearScore, and specialist identity-protection providers such LifeLock.

* FY25 , from ongoing activities