What we do

We are a data and technology powerhouse. We help individuals take control of their financial lives and follow their dreams. Businesses rely on our valuable data and powerful analytics to make smarter decisions and to mitigate risk. We are changing lending, helping businesses detect more fraud, simplifying healthcare, making it easier to get a car, enabling business to understand their target customers, and much more.

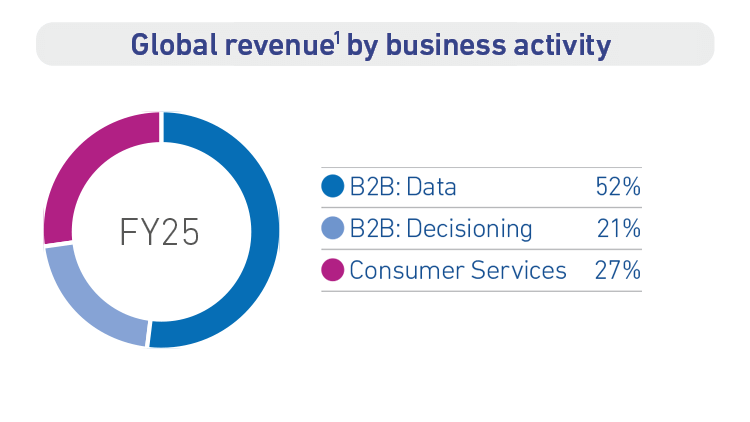

Our business activities

Business to business

We empower businesses to make faster, smarter decisions by transforming complex data into actionable insights. From credit risk assessment to fraud prevention and market analysis, our solutions help organisations innovate and grow with confidence.

Consumer Services

We provide individuals with tools and resources to take control of their financial health and achieve their goals. Through personalised offers, monitoring services and identity protection, we help people build brighter financial futures.

1 = from ongoing activities

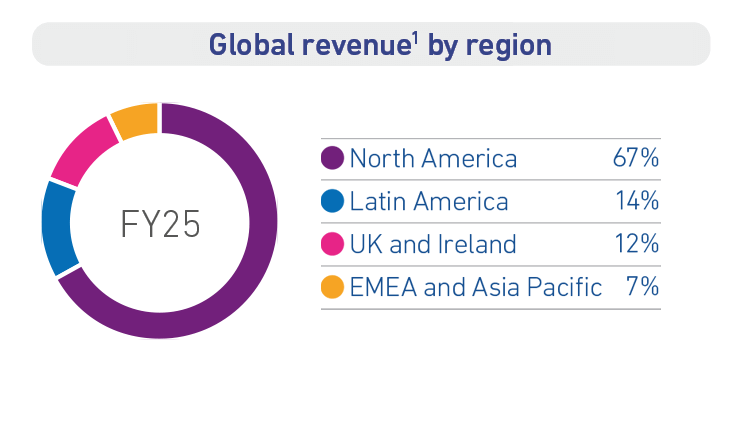

Where we operate

We provide services across four geographic operating segments. This regional structure means we can better understand the specific needs and constraints of each local market and we are able to service both domestic and international customers effectively.

Our global reach means we can offer our customers the benefit of shared product development and market knowledge.

1 = from ongoing activities

2 = In FY25, we earned over 90% of our revenue across our top three countries – the USA, Brazil and the UK.

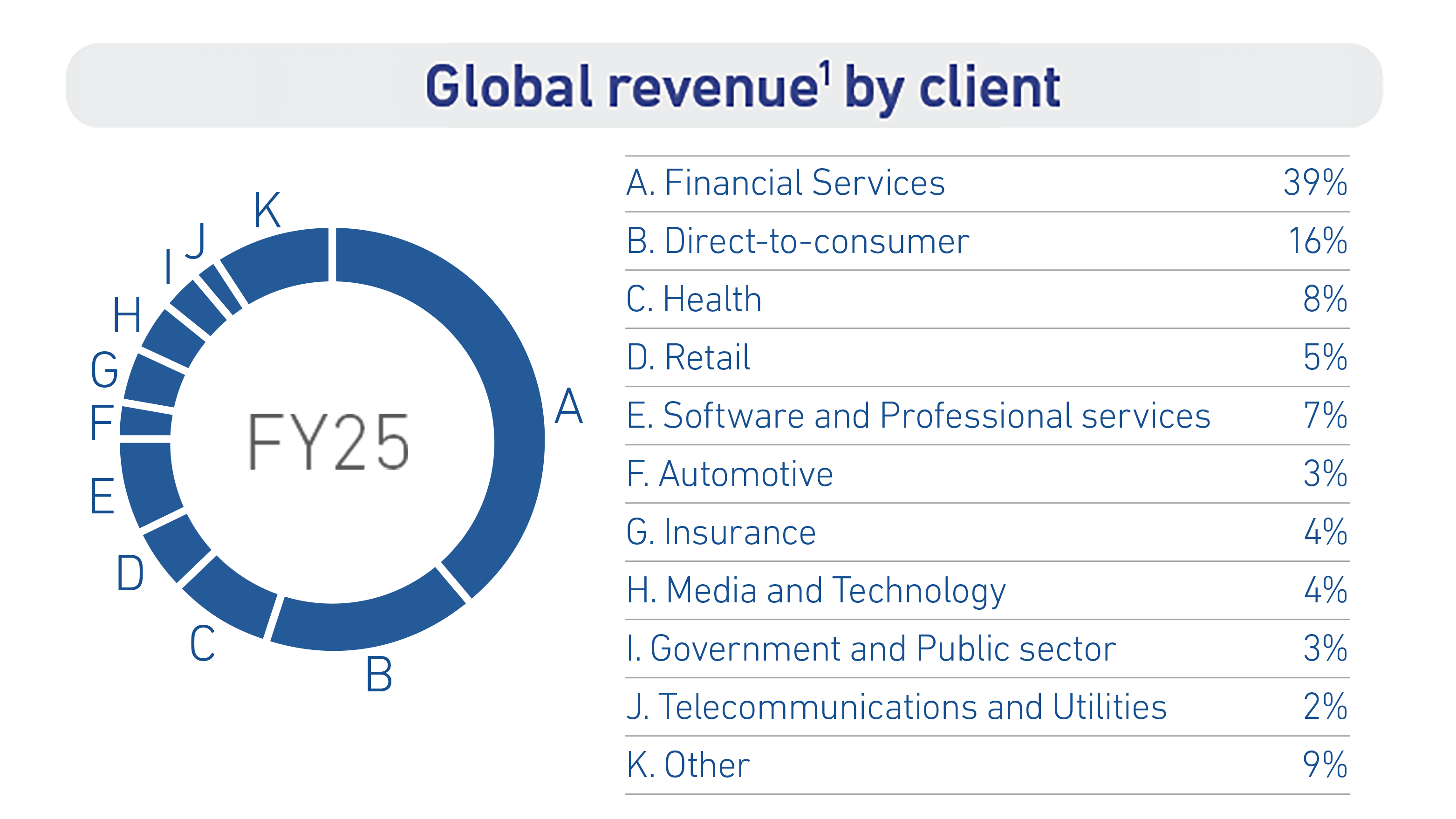

Who we serve

Our customer base is diverse.

Millions of individuals rely on us to simplify access to credit and insurance options, helping them save time and money while improving their financial health. We also support a diverse range of businesses, from small enterprises to multinational organisations. These businesses leverage our data and decision intelligence platforms to drive growth, mitigate risk, and engage more effectively with their customers.

1 = from ongoing activities

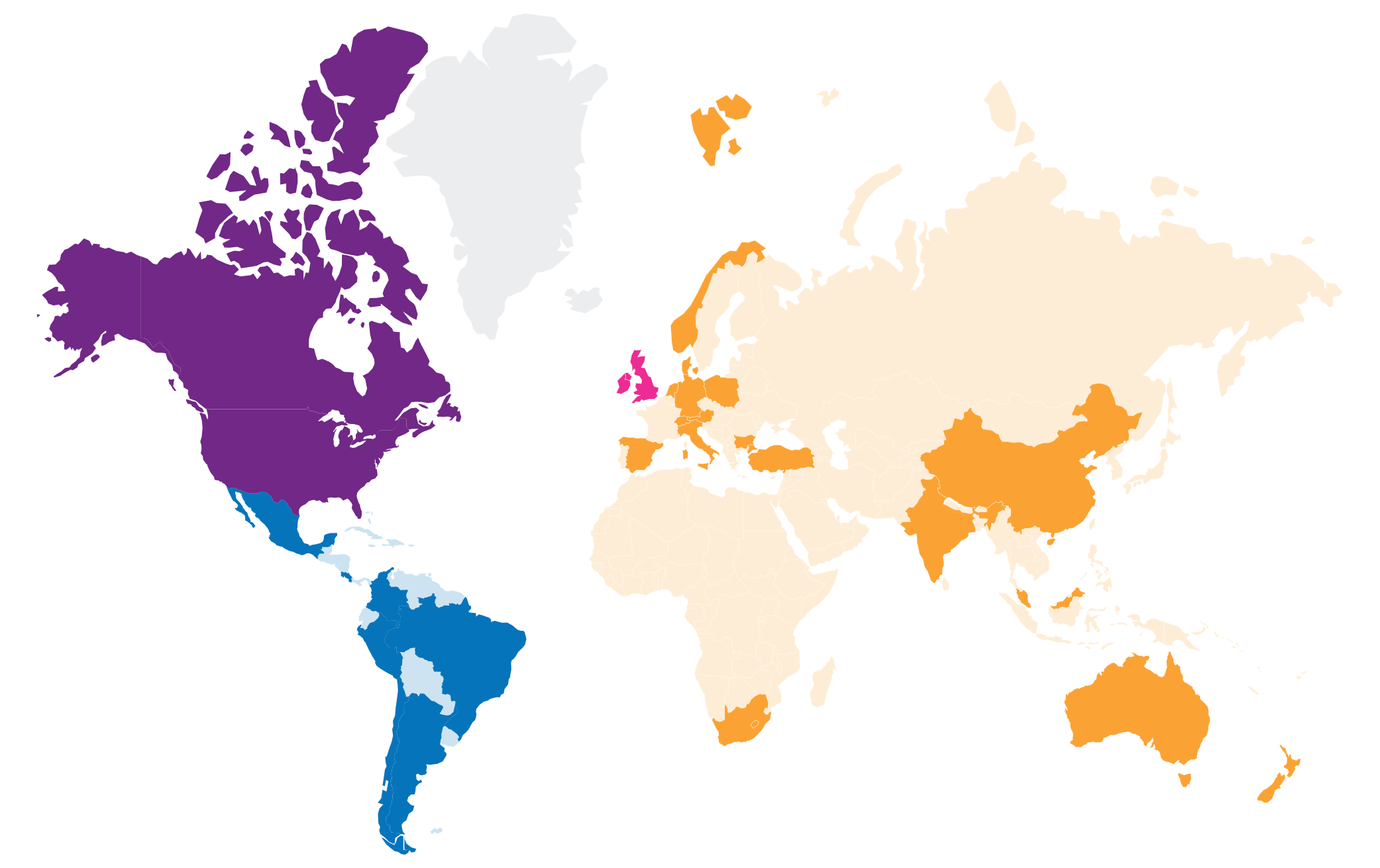

Countries where we operate

| North America | Latin America | UK and Ireland | EMEA and Asia Pacific |

|

|

|

|